Internal Audit & Controls Advisory

Strengthening governance, risk management, and control effectiveness through practical, business-aligned internal audit and ICFR frameworks.

OUR CLIENT

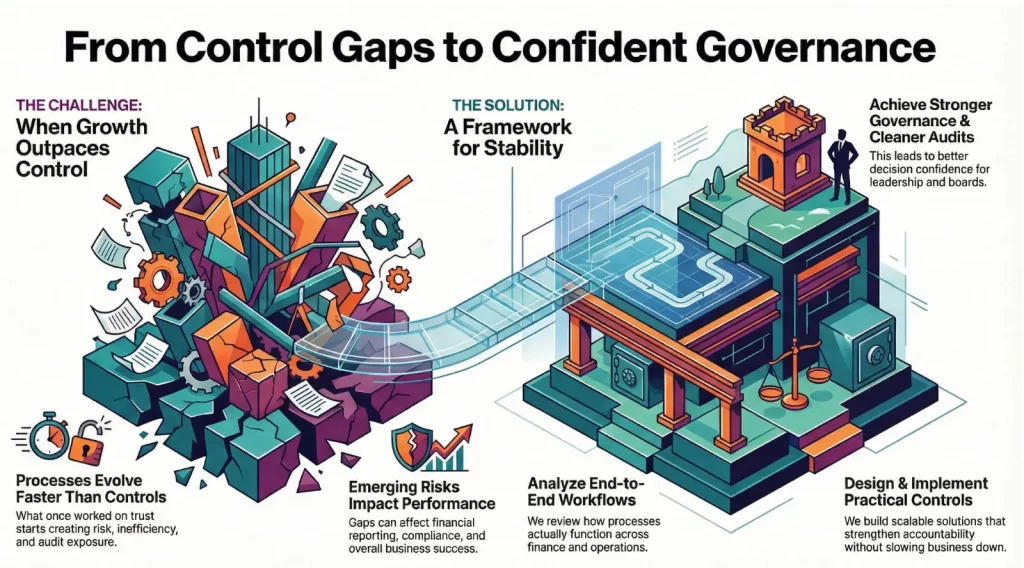

As businesses scale, risks grow quietly in the background.

Processes evolve. Teams expand. Transactions multiply.

Controls that once worked start breaking, often without anyone noticing. Issues surface late. Sometimes too late.

Our Internal Audit & Controls Advisory services help businesses stay ahead of risk while growth continues. We focus on practical controls, clear accountability, and processes that actually work on the ground.

What This Service Does

We work closely with management to review, strengthen, and embed internal controls across finance and operations, without slowing the business down.

What You Get

- Review of key business and finance processes end to end

- Identification of control gaps, risks, and leakage points

- Practical control design aligned to scale and complexity

- Maker-checker frameworks and approval matrices

- Support for ICFOR, audit readiness, and compliance expectations

- Clear action plans, not long audit reports

This service suits businesses that want control without bureaucracy and governance without friction.

How We Engage

Our engagement model is simple, structured, and flexible.

Diagnose

Design

Deliver

Review & Scale

OUR CLIENT

Clients choose ANKR because we go beyond advice.

- Strong understanding of finance processes and systems

- Practical, business-aligned control design

- Experience across MNCs, GCCs, and Indian corporates

- Partner-led oversight and execution

- Clear reporting with actionable recommendations

We focus on control effectiveness, not just documentation completeness.

Best Suited For

Built for organizations where operations have grown faster than controls.

Ideal for management teams that want visibility into risks, process gaps, and control failures before they turn into losses, audit issues, or regulatory trouble.

As transaction volume, systems, and teams expand, informal checks stop working. Internal audit brings structure, accountability, and confidence.

If you rely on people instead of processes, this is meant for you.

- Founder-led businesses

- Scaling startups and SMEs

- PE / VC-backed companies

- Businesses preparing for fundraising

- Companies facing increasing finance complexity

- Promoters needing senior finance oversight without a full-time CFO

Founder-led and family-managed businesses

Growing companies and mid-sized enterprises

PE / VC-backed companies

Companies preparing for statutory or internal audits

Businesses facing leakage or control breakdowns

Strengthening Governance, Controls, and Risk Management

We support organizations in designing and operating effective internal control frameworks that scale with business growth and regulatory expectations.

Scope of Services:

- Risk assessment and internal audit planning aligned to business objectives

- ICFOR and audit readiness support

- Identification of control gaps, deficiencies, and risk exposures

Internal Audit & Controls Services Creates Impact

01

Clear, decision-ready MIS

Implemented structured cash flow tracking, monthly MIS, and lender coordination, resulting in improved liquidity visibility and smoother banking relationships.

01

Risk-based and scalable approach

02

Practical recommendations with implementation support

03

Alignment with audit and regulatory expectations

04

Ongoing or project-based engagements

CFO Office Services

We provide strategic financial leadership to drive business growth and efficiency

Our CFO Office Services provide businesses with strategic financial leadership, enabling them to navigate complex financial landscapes with confidence. We offer comprehensive solutions that drive financial efficiency, optimize performance, and support long-term growth. Our services include:

- Financial Strategy & Planning: Developing and implementing tailored financial strategies to achieve business objectives.

- Budgeting & Forecasting: Ensuring accurate financial planning to drive informed decision-making.

- Cash Flow Management: Enhancing liquidity and financial stability through expert cash flow oversight.

- Risk & Compliance Management: Mitigating financial risks while ensuring compliance with regulatory requirements.

- Investor Relations & Fundraising Support: Strengthening financial positioning to attract investors and secure funding.

- Performance Monitoring & Reporting: Providing actionable insights through detailed financial analysis and reporting.

1. What does a CFO Office Service include?

Our service covers financial planning, reporting, compliance, cash flow management, performance monitoring, and strategic financial leadership tailored to your business.

2. Do you work with startups, SMEs, or large enterprises?

Yes - we support organizations of all sizes. Our solutions scale based on business maturity, operational structure, and financial complexity.

3. Can we outsource only certain CFO functions?

Absolutely. You can choose full-scale support or specific modules such as budgeting, forecasting, reporting, compliance, or investor support.

4. How long does onboarding typically take?

Onboarding timelines vary based on system readiness and process maturity, but most engagements begin delivering value within the first 2–4 weeks.

More Services

Contact With us

91 Springboard, Mytri Square, Prashanth Nagar Colony, Gachibowli, Kondapur, Telangana

Call For Inquiry

63009 01951

Get in Touch

Case Studies

ICFR Framework Development for Unicorn

Designed and implemented an ICFR framework to support scale, governance, and audit readiness.

Process Review and Documentation for Large GCC

Reviewed and documented end-to-end finance processes for a large Global Capability Centre.

Risk-Based Internal Audit for Corporate Group

Executed a risk-based internal audit to assess control effectiveness and operational discipline.

Special Controls Review Engagement for MNC

Performed a focused controls review to address specific risk and audit concerns.

What you see

Scalable Solutions

Automation Features

24/7 Support

- Business Strategy

- Financial Consulting

- Marketing & Branding

- Sales Consulting

- Human Resources

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

With an innovative approach to problem-solving, we recognize solutions as a driving force

Business Success

88%- Designing Tailored Solutions

- Enhance Operational Efficiency

- Designing Tailored Solutions

- Dedicated Team member

- Delivering Exceptional Value

- Continuous Improvement

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

With an innovative approach to problem-solving, we recognize solutions as a driving force

Business Success

88%- Designing Tailored Solutions

- Enhance Operational Efficiency

- Designing Tailored Solutions

- Dedicated Team member

- Delivering Exceptional Value

- Continuous Improvement

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach