Techno-Finance Skill Development

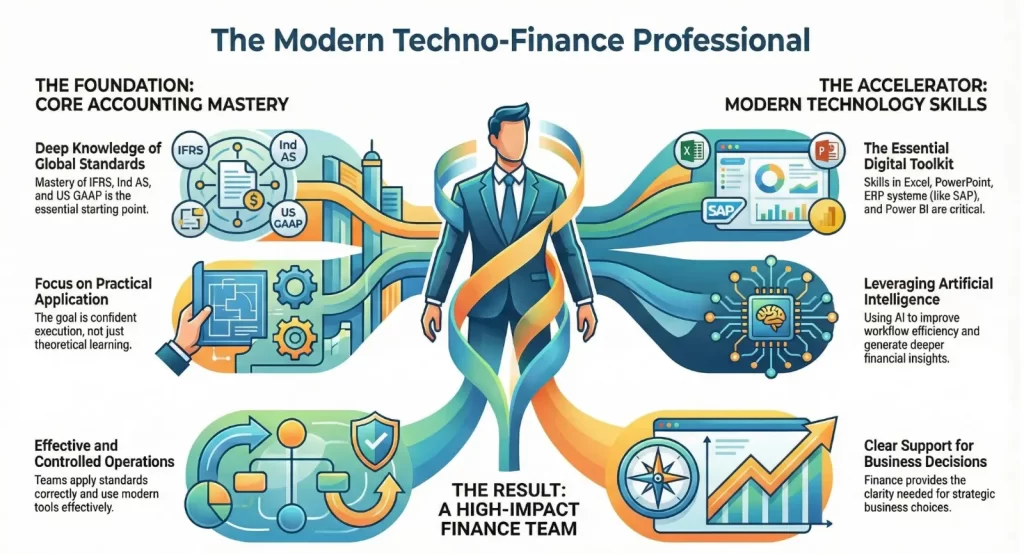

Customized capability building for finance and accounting professionals combining accounting standards, financial analysis, and modern finance technology.

OUR CLIENT

Strong finance teams fail when skills stop evolving.

Standards change. Tools change. Expectations rise.

Teams stay busy, but capability does not grow at the same pace. Reporting becomes slow. Analysis stays basic. Technology remains underused.

Our Techno-Finance Skill Development programs help finance professionals move from routine execution to high-impact contribution.

This is not classroom training. It is role-based, practical, and built around real business work.

What This Service Does

We upskill finance and accounting teams across core accounting, reporting, and modern finance tools so they can think better, work faster, and add real value to the business.

What You Get

- Deep training on Ind AS, IFRS, and US GAAP with practical application

- Advanced Excel, PowerPoint, and business presentation skills for finance roles

- Hands-on exposure to Power BI, dashboards, and management reporting

- Practical use of AI and automation in finance and accounting workflows

- Role-based programs for junior, mid-level, and leadership teams

This service works best for organizations that want finance teams who do more than close books and prepare reports.

How We Engage

Our engagement model is simple, structured, and flexible.

Diagnose

Design

Deliver

Review & Scale

OUR CLIENT

Clients choose ANKR because we go beyond advice.

- Trainers with deep corporate and consulting experience

- Strong expertise across accounting standards and finance technology

- Practical, business-aligned programs

- High engagement and accountability model

- Focus on real impact, not just training hours

We build techno-finance professionals who perform, not just participate.

Best Suited For

Designed for large organizations where finance teams handle high volumes, multiple systems, and strict reporting timelines.

In MNCs and listed companies, the gap is not accounting knowledge. The gap is execution. Teams struggle to connect ERPs, Excel, reporting tools, and accounting logic into one smooth workflow.

This service strengthens finance capability at scale, so teams deliver accuracy, speed, and insights without constant rework or escalation.

If your finance function is strong but stretched, this is built for you.

- Founder-led businesses

- Scaling startups and SMEs

- PE / VC-backed companies

- Businesses preparing for fundraising

- Companies facing increasing finance complexity

- Promoters needing senior finance oversight without a full-time CFO

Large MNC finance teams

Listed companies

Shared Services and GCCs

Companies running ERP and reporting transformations

Senior finance leadership programs

Building Future-Ready Finance Teams

We help organizations upskill finance and accounting teams to meet evolving business, regulatory, and technology demands.

Scope of Services:

- Training on Ind AS, IFRS, and US GAAP with real business scenarios

- Advanced Excel, PowerPoint, and management reporting skills for finance teams

- Power BI and dashboarding for data-driven decision support

Skill Development Service Creates Impact

01

Clear, decision-ready MIS

Implemented structured cash flow tracking, monthly MIS, and lender coordination, resulting in improved liquidity visibility and smoother banking relationships.

01

Clear, decision-ready MIS

02

Strong cash flow visibility and control

03

Structured budgeting and forecasting

04

Confident board and investor conversations

CFO Office Services

We provide strategic financial leadership to drive business growth and efficiency

Our CFO Office Services provide businesses with strategic financial leadership, enabling them to navigate complex financial landscapes with confidence. We offer comprehensive solutions that drive financial efficiency, optimize performance, and support long-term growth. Our services include:

- Financial Strategy & Planning: Developing and implementing tailored financial strategies to achieve business objectives.

- Budgeting & Forecasting: Ensuring accurate financial planning to drive informed decision-making.

- Cash Flow Management: Enhancing liquidity and financial stability through expert cash flow oversight.

- Risk & Compliance Management: Mitigating financial risks while ensuring compliance with regulatory requirements.

- Investor Relations & Fundraising Support: Strengthening financial positioning to attract investors and secure funding.

- Performance Monitoring & Reporting: Providing actionable insights through detailed financial analysis and reporting.

1. What does a CFO Office Service include?

Our service covers financial planning, reporting, compliance, cash flow management, performance monitoring, and strategic financial leadership tailored to your business.

2. Do you work with startups, SMEs, or large enterprises?

Yes - we support organizations of all sizes. Our solutions scale based on business maturity, operational structure, and financial complexity.

3. Can we outsource only certain CFO functions?

Absolutely. You can choose full-scale support or specific modules such as budgeting, forecasting, reporting, compliance, or investor support.

4. How long does onboarding typically take?

Onboarding timelines vary based on system readiness and process maturity, but most engagements begin delivering value within the first 2–4 weeks.

More Services

Contact With us

91 Springboard, Mytri Square, Prashanth Nagar Colony, Gachibowli, Kondapur, Telangana

Call For Inquiry

63009 01951

Get in Touch

Case Studies

Customized US GAAP & IFRS Program for Global GCC

Built deep, practical accounting standards capability for a global GCC finance team.

Excel & Business Presentation Skills for Finance Professionals

Strengthened analytical and communication skills of finance teams at a unicorn startup.

Finance Analytics & Insights Program for Renewable Energy Company

Developed analytical capability using statistics, Python, and data visualisation for finance teams.

Financial Modeling Program for Experienced Finance Professionals

Delivered advanced financial modeling capability for decision-making and business evaluation.

What you see

Scalable Solutions

Automation Features

24/7 Support

- Business Strategy

- Financial Consulting

- Marketing & Branding

- Sales Consulting

- Human Resources

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

With an innovative approach to problem-solving, we recognize solutions as a driving force

Business Success

88%- Designing Tailored Solutions

- Enhance Operational Efficiency

- Designing Tailored Solutions

- Dedicated Team member

- Delivering Exceptional Value

- Continuous Improvement

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach

With an innovative approach to problem-solving, we recognize solutions as a driving force

Business Success

88%- Designing Tailored Solutions

- Enhance Operational Efficiency

- Designing Tailored Solutions

- Dedicated Team member

- Delivering Exceptional Value

- Continuous Improvement

We Helping You Unlock the Opportunities, Success.

Exploring alternatives such as social media advertising, influencer partnerships email marketing, & SEO optimization can help diversify your reach